Are You Ready to Deal with Trump’s Trade Tariffs?

Insights into how new tariff rates are reshaping global trade and supply chains in four key industries

US President Donald J. Trump is making good on his promise to “Make America Great Again” by imposing reciprocal tariffs on goods entering the United States. His motives may vary—leveling the playing field, protecting US jobs, domestic security or curbing fentanyl trade —but the outcome is clear: global trade is being disrupted, and supply chains are in turmoil.

What’s next? Nobody knows …

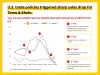

On April 2, 2025—“Liberation Day”—the Trump Administration unveiled its new global tariff regime: 10% tariff on all imports; with additional country specific reciprocal tariffs.

Soon after, sector-specific tariffs and concessions were announced and an escalating trade war with China was triggered. The conflict peaked when the USA imposed a 145% tariff on Chinese goods, while China retaliated with 125% tariffs on US products and restrictions on rare earth metal exports.

These swings—tariffs, exemptions, and shifting trade deals—are creating unprecedented uncertainty. For global businesses, the challenge is staying prepared for constant change.

At DHL Consulting, we are tracking developments closely and have identified strategic supply chain imperatives across four highly exposed industries.

Automotive

Trump’s auto tariff is set to raise vehicle costs by around $3,000. While this is more painful for consumer, the state’s intention is clear: The long-term goal to re-industrialize the country and bring the auto supply chain back to the USA – not just car production but also key spare parts manufacturing.

To move in this direction, the administration has introduced targeted exceptions that incentivize US-based production while in short-term accommodating key trade partners’ push for lower tariff rates:

- 3.75% import credit for US-assembled cars.

- No tariff stacking on auto parts (beyond steel and aluminum)

- USMCA exemptions; with progressively fewer exceptions year on year.

- Exemptions for vehicles with ≥85% US-made components.

- Country specific tariff rates – capped at 15% for Korea, the EU, and Japan; but increase from a previous 2.5% baseline.

How Automakers Are Responding

Leading brands such as Honda, Nissan, and Ford are already adapting by reshaping their supply chain strategies. Four moves stand out:

- Localize – expand production capacity in the United States

- Partner – collaborate with other OEMs to maximize US manufacturing capacity

- Rethink – redesign supply chains for US-market resilience, including diversifying parts sourcing

- Diversify revenue – capitalize on the rapidly booming used car market as consumer demand shifts

E-retail

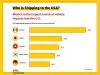

The tariff turmoil has already triggered a sharp drop in sales for Shein and Temu, which sell cheap products directly from China. The primary reason has been the elimination of the USD 800 duty-free de minimis thresholds for goods from China and Hong Kong, which took effect on May 2, 2025.

It was this customs loophole that allowed these two companies, for instance, to bypass paying duties on low-priced goods to the USA by shipping them directly from Asia.

These e-commerce retailers, however, had already begun future-proofing their supply chains before the Trump shock hit. They had partially shifted their supply model from direct shipment to local fulfillment, with inventory stocked in the destination countries and dispatched from a fulfillment warehouse.

But the question arises: Will this be enough in the long term? There are additional steps that e-retail manufacturers and platforms can take to have an increased chance of keeping revenue and operations flowing:

- Rethink target market – by tapping into new markets, such as Africa or the EU, and revenue sources, or diversifying and optimizing your product portfolio to contain more premium goods

- Stay ahead of regulations – with a data-driven approach, auditing product origin data or upgrading systems to capture key product data

- Offer more sustainable recommerce options – allowing you to bypass overseas manufacturing and shipping costs while catering to consumers’ demand for more conscious retail

Pharmaceuticals

Trump wants the best of two worlds: low prices and local production. He is aiming to secure national security of the pharma supply chain and create quality jobs – while drastically lowering prescription drug prices in the country. Consequently, the tariffs’ impact on the pharma supply chain will differ between branded pharma and generic drugs.

America accounts for 53% of the global pharma prescription drugs market (statista), making it highly attractive to branded pharma companies, who also receive subsidy and tax benefits if they invest in the USA.

Since Trump won the Presidential election in 2024, a number of pharmaceutical companies – such as AstraZeneca, Johnson & Johnson, and Eli Lilly – have ramped up their US investments, with a total of USD 250 billion planned for onshoring production to the USA.

In contrast, generic drug production may remain located overseas to keep price competitive. However, this may mean that generic drug manufacturers will need to face uncertainty under Trump’s bilateral tariff deals. This could drive drug shortages and higher costs if exemptions are not secured.

Strategic responses:

Branded

- Leverage US subsidies and review strategic investments

- Evaluate price strategies and mitigation methods under Trump’s price cutting policies

- Consider alternative solutions like Contract Development Manufacturing Organizations (CDMOs)

Generic

- Reassess production bases (eg., India vs China) under Trump’s new trade deals

- Prepare contingency plan by simulating various tariff scenarios

- Stay close to customs experts to understand the latest customs policies and solutions

Semiconductors

In 1990, the US produced 37% of global semiconductors. By 2022, that share had fallen to 10%. Today, Taiwan and South Korea dominate advanced chipmaking. With AI and technology race, semiconductor not only remains an important supply chain asset, but is also a question of strategic geopolitical advantage for economies.

Trump’s strategy to revitalize the semiconductor manufacturing in USA is twofold:

- Impose sky-high tariffs on chip import

- Incentivize onshoring with tax credits and incentives to rebuild domestic capacity

Additionally, it seeks to restrict competition and the development of advanced technology in rival countries, such as China, by imposing strict export controls on trade with them

For semiconductor and upstream players, the strategic imperativeis on to invest in US hot spots like Arizona, Idaho, New York, Ohio, and Texas and secure supply of materials to these hubs.

Make sure you are ready to deal with the new Trump tariffs

Global trade and supply chains are being reshaped in real time. The world is shifting from “just in time” to “just in case,” with agility now the defining trait of successful supply chains.

Whether Trump’s tariffs will truly re-industrialize America is uncertain. What is certain: companies must re-examine supply chains, stress-test against new tariff regimes, and prepare for more trade shocks ahead.

At DHL Consulting, we have helped clients navigate seismic changes before—such as Brexit—and we’re doing the same now. Our experts provide:

- Supply chain simulations of tariff impacts

- Strategic roadmaps to identify vulnerabilities and opportunities

- Direct access to customs expertise and operational insights

We will continue to monitor developments and provide practical guidance to help you stay ahead in an unpredictable trade landscape.

Contact Us

Christine Wang leads our APAC practice in helping clients build resilient supply chains. Reach out to start the conversation.

- Connect on LinkedIn

- christine.wang2@dhl.com